How Much Will I Net? Part Two

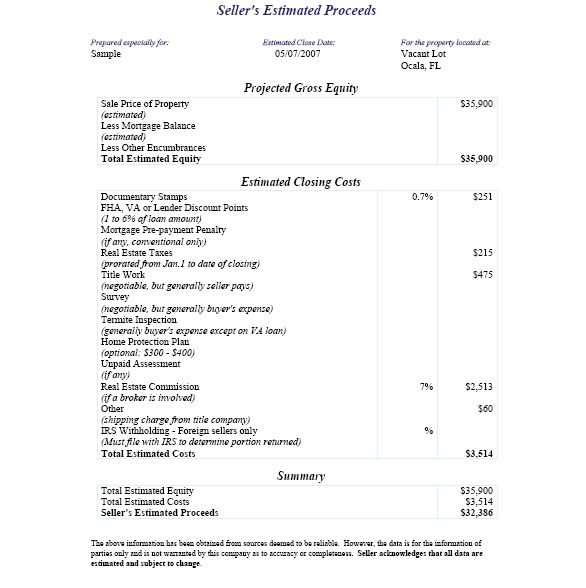

Last time we talked about the disclaimer on the Seller's Net Proceeds Sheet, and the first section. Please refer back to the photo on the left to follow along. (click the photo for a larger image)

Listed first in section two of our sample net sheet is the listing of Documentary Stamps, or Doc Stamps as they are more commonly called. This charge is from the State of Florida, and we can not change it. It is not negotiable, as the fee does not go to anyone in the real estate company, nor at the title company. The rate is currently .07% or .007 multiplied by the purchase price.

The next part you'll notice that I have filled in is the Real Estate Taxes portion, also known as Property Taxes. Different areas of the country handle payment of property taxes in different ways. In Marion County, Florida, property taxes are paid in arrears, not in advance like some other areas. That means when you get your tax bill and pay it in November, you are paying for the year that has mostly gone by already. For 2006, if you paid in December of 2006, you paid for January through the end of December of 2006.

So, when you go to sell the vacant land, you, the seller, are responsible for the taxes from January 1st, through the Day of Closing (plus and outstanding tax bills from prior years).

This is all handled nice and neatly on the settlement statement as a debit from you for your portion, credited to the buyer. The buyer signs a statement acknowledging that they have received the funds for the taxes. When the tax bill then comes due at the end of the year, it is the buyers bill...you have already paid your share, and they acknowledged that fact in writing!

The next section I have filled out is for Title Work. I could write and write on that subject, but for simplicity sake, let me just reiterate what it says on the sheet. While it technically IS a negotiable item (who pays), it is customary in Marion County, and Ocala, Florida for the seller to pay it and to choose what company is used. If a buyer wants or needs to choose what company is used, they customarily will take over that charge. Occasionally, that is impossible for certain reasons that the agents involved should be able to explain to your satisfaction. It does happen occasionally, but that's a post for another time.

Next up is commission. I shouldn't have to say it, but yes, it is also a negotiable item. You, the consumer, as the seller may attempt to negotiate a lower listing commission with the brokerage. This should be done BEFORE signing a listing agreement. I can not comment any further on that particular subject, unfortunately.

Other: One thing that is common with vacant lot sales, is "mail-away" closings. Most vacant lot owners live somewhere else, and travelling here for the closing is not feasible, or necessary. The title companies generally charge this fee to cover their over-night charges. For example: They FedEX the closing package to you, with a return envelope. Then they FedEx your check to you when the closing is complete.

IRS Withholding: If you are selling property here, but are not a US citizen, then you probably already know all about this. If you do not, please email me.

That's it! The mystery of the closing costs involved in selling vacant land is gone! Just please remember, the figures are estimates only. No one can give you exact figures until closing. If there are extra documents that need to be recorded, or leins that show up that have to be paid, or any number of other surprises, it changes the costs. Sometimes it's a drastic change, but we just don't know until the title search is done.

Labels: closing costs, selling property, Vacant Lots

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home